Sage Payroll Users, need to know…

All employers have to re-enrol all employees who opted out of Auto enrolment pension 3 years after the initial staging Date for the company.

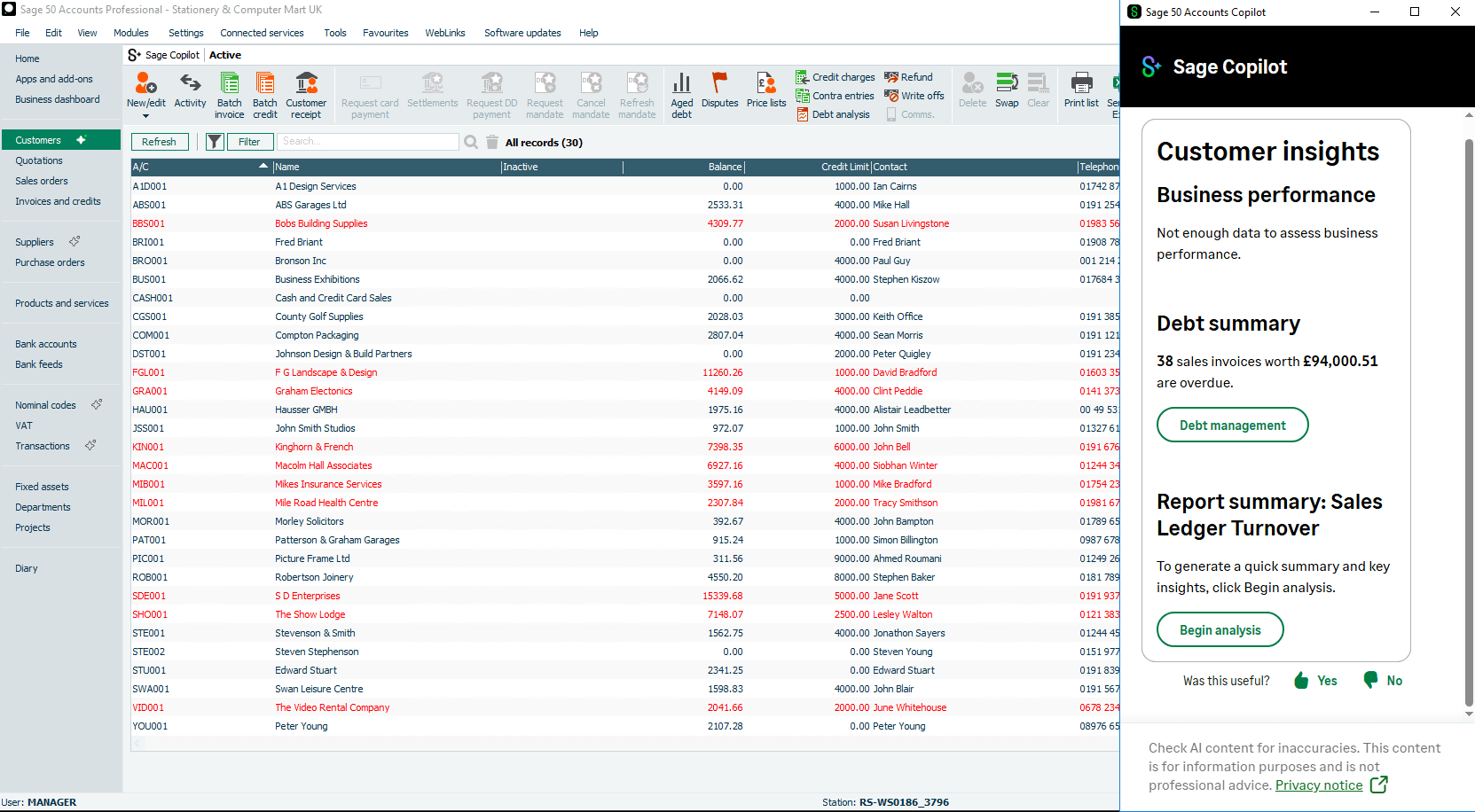

If the staging date is set in sage and you have reached the 3rd anniversary of this then Sage will automatically re-enrol any employees who had left when you next run the pension assessment as part of your payroll run.

The employees will then have to re opt-out of the scheme, the same as they did when the initial staging date was reached.

If the employee has only opted out within the last 12 months when running the re-assessment then you have the option within the cyclical pension settings in Sage Payroll to not re-enrol these staff (has to be set the default is to re-enrol).

Allied to this the employer also has to inform HMRC that they have complied with the regulations within 5 months of the re-enrolment date. If the employer has not done this, then they will get a letter from HMRC warning of them not having updated HMRC with the information and will face a fine of £400, if they do not update HMRC to confirm the compliance with re-enrolment.

The update can be done via an online form for which there is a link within the pension centre in Sage payroll for those who have the pensions module.

This notification bit is the same as the employer has to do when initially enrolling for Auto enrolment pension. If you would like to know any more about this auto-enrolment feature, contact our expert team.