The final phase of Making Tax Digital (MTD) came into effect on the 1st November 2022, but what was this change & how will it affect your business? Carry on reading this blog to find out more!

By law, all VAT-registered businesses must have now signed up to Making Tax Digital (MTD) and use compatible software to keep their VAT records & file their returns. Any business using an outdated VAT online account to submit VAT returns will need to swap over immediately. Even if you are currently using MTD compatible software to file your VAT returns online, you must remember to sign up to MTD before you file your next return.

What to do if you haven’t signed up to MTD

Here are the steps you need to follow if you have not signed up to MTD or started using compatible software:

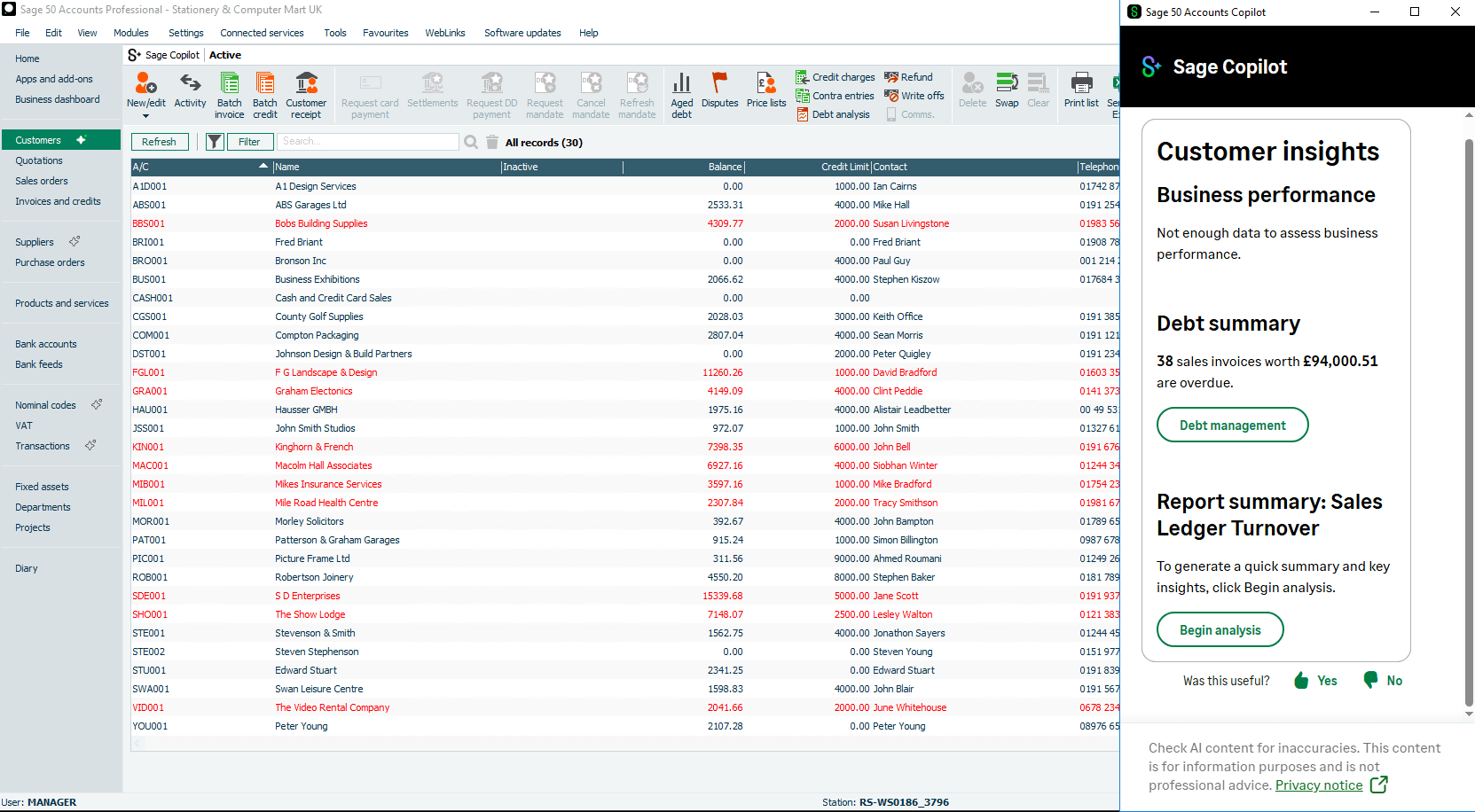

- Choose MTD-compatible software (Sage 50cloud or any other Sage Business Cloud software is perfect).

- Check permissions in the software – this links the MTD software to the Gov.uk website so VAT returns can be filed easily.

- Start keeping digital records for both current and future VAT returns

- Sign up for MTD and file future VAT returns using MTD-compatible software

If you do get stuck, the Gov.uk website has some guidance on MTD and information on how you can ensure your business is compliant. There is a caveat to be aware of too:

If your business turnover is under the VAT threshold of £85,000 and you haven’t signed up for MTD for VAT in enough time to submit your next tax return by the 7th November, you can use your existing VAT online account.

If you require any further assistance with MTD, get in touch with our expert Sage team today on 01482 828000.

*This article contains general information in order to assist all of our customers and is meant for guidance only – there are no guarantees that the information we provide will be suitable for your particular needs. If you require specific assistance, we recommend that you seek professional guidance on your individual circumstances. Reality Solutions are in no way responsible for any loss or damage arising from any information contained within our articles.